Tax season is a prime time for IRS scams, with fraudsters targeting unsuspecting taxpayers. These scams can take various forms, including fake IRS emails, phone calls, and letters. Last year, a significant number of identity theft complaints were reported to the IRS, highlighting the growing threat. Scammers exploit personal information to file fraudulent tax returns and claim refunds. As a taxpayer, it’s crucial to recognize the signs of these scams and take proactive steps to protect your personal and financial information. Let’s take a look at how to identify IRS scams and what you can do to avoid falling victim to these schemes.

Understanding IRS Scams

IRS scams are deceptive tactics used by fraudsters to steal your personal information and money. These scams can manifest in various forms:

- IRS Scam Emails: These emails appear to be from the IRS, often containing urgent messages or threats of legal action. They may ask for personal information or direct you to a fake website.

- IRS Scam Calls: Scammers may call you, posing as IRS agents. They might demand immediate payment of taxes or threaten arrest.

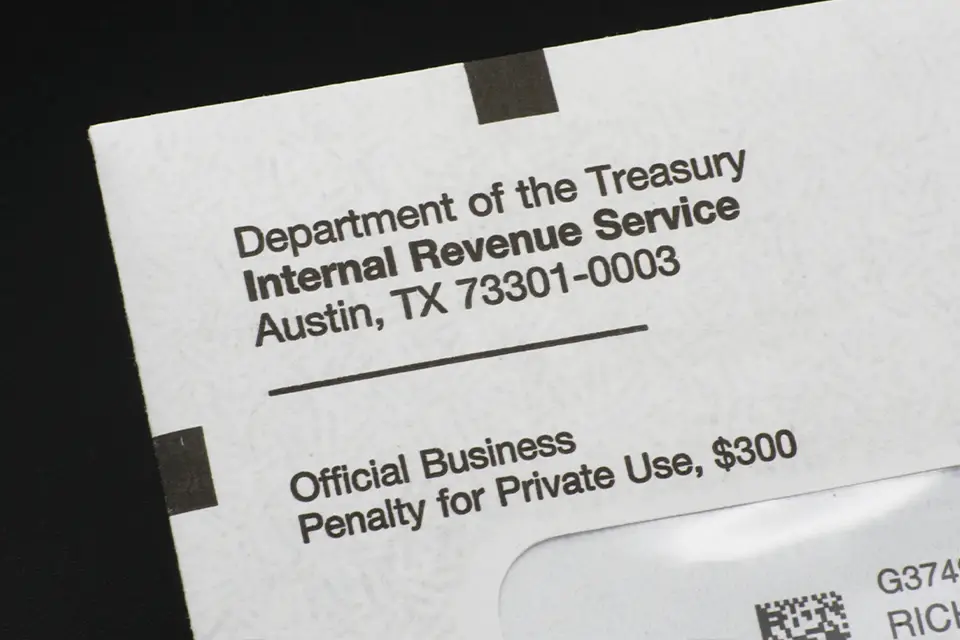

- Fake IRS Letters: You might receive letters that look official, claiming you owe taxes or need to verify your identity.

- Text Message Scams: Fraudsters may send texts claiming to be from the IRS, asking for personal information or payment.

Recent statistics show a concerning rise in IRS-related identity theft. Last year, the IRS received 294,138 complaints of reported identity theft, the second-highest number in its history. Cybercriminals trade and sell personal data, making it easier for them to commit tax fraud in your name.

To protect yourself, it’s essential to recognize these scams and understand that the IRS has specific communication policies:

- The IRS does not initiate contact with taxpayers via email, text, or social media to request personal or financial information.

- Official IRS correspondence is typically sent through the mail.

- The IRS will never demand immediate payment over the phone or ask for payment via gift cards or cryptocurrency.

By staying informed about these scams, you can safeguard your personal information and avoid falling victim to fraudsters.

Common Tactics Used for IRS Scams

Scammers employ various tactics to trick taxpayers into revealing their personal and financial information. Understanding these tactics can help you identify IRS scams:

- Urgent and Threatening Messages: Scammers often create a sense of urgency or fear, claiming that you owe taxes or face legal consequences if you don’t respond immediately.

- Request for Personal Information: Be wary of any communication asking for your Social Security number, bank account details, or other sensitive information.

- Impersonation: Scammers may pose as IRS agents, tax professionals, or other authorities to gain your trust.

- Phishing Links: Emails or texts may contain links to fake websites designed to steal your information. Always check the URL before clicking.

- Payment Demands: Fraudsters may insist on immediate payment through unusual methods, such as gift cards, wire transfers, or cryptocurrency.

- Spoofing: Scammers can manipulate caller ID or email addresses to appear as if they’re coming from the IRS or a legitimate organization.

To protect yourself, always verify the identity of the person contacting you and be cautious of unsolicited communications. If you receive a suspicious call or email, do not provide any personal information and report the incident to the IRS.

How the IRS Communicates with Taxpayers

Many wonder how the IRS contacts taxpayers. Here are key points to remember:

- Official Correspondence: The IRS primarily communicates through mailed letters for official matters, including audit notifications or tax due notices.

- Emails: The IRS does not email taxpayers about personal tax issues. Any email claiming to be from the IRS asking for personal information is a scam.

- Phone Calls: While the IRS may call taxpayers in some cases, they do not threaten legal action or demand immediate payment over the phone. Always verify the caller’s identity by contacting the IRS directly.

- Text Messages and Social Media: The IRS does not use text messages or social media to discuss personal tax matters. Any such communication is fraudulent.

If you receive a communication claiming to be from the IRS and are unsure of its legitimacy, do not provide any personal information. Instead, contact the IRS directly through their official website or customer service line to verify the communication.

Protecting Yourself from IRS Scams

Taking proactive steps to protect your personal and financial information is crucial during tax season. Here are some tips:

- File Early: Filing your tax return early can prevent scammers from filing a fraudulent return in your name.

- Use Secure Networks: When filing your taxes online, ensure you’re using a secure, encrypted network.

- Enroll in the IRS IP PIN Program: The IP PIN (Identity Protection Personal Identification Number) adds an extra layer of security to your tax return.

- Beware of Phishing Attempts: Do not click on links or download attachments from suspicious emails or texts claiming to be from the IRS.

- Monitor Your Credit: Regularly check your credit report for any unusual activity that could indicate identity theft.

- Report Suspicious Activity: If you suspect you’ve been targeted by an IRS scam, report it to the IRS and the Federal Trade Commission (FTC) immediately.

By following these steps, you can significantly reduce your risk of falling victim to IRS scams and ensure a safer tax season.

What to Do If You Suspect a Scam

If you encounter a potential IRS scam, taking immediate action is crucial. Here’s what you should do:

- Do Not Engage: If you receive a suspicious call, email, or letter, do not respond or provide any personal information.

- Verify the Contact: If you’re unsure whether a communication is legitimate, contact the IRS directly using the contact information on their official website.

- Report the Scam: Report suspected IRS scams to the Treasury Inspector General for Tax Administration (TIGTA) and the Federal Trade Commission (FTC) through their respective websites.

- Protect Your Information: If you believe your personal information has been compromised, consider placing a fraud alert on your credit reports and monitoring your accounts for unusual activity.

- Seek Professional Help: If you need assistance or have fallen victim to a scam, consider reaching out to a tax professional or the IRS for guidance.

By being vigilant and taking prompt action, you can help prevent the spread of IRS scams and protect yourself and others from potential financial harm.

Conclusion

As tax season unfolds, staying vigilant against IRS scams is more important than ever. By recognizing the signs of fraudulent activity and taking proactive steps to protect your personal information, you can avoid falling prey to these schemes. Remember, the IRS has specific communication policies, and understanding these can help you identify and avoid scams.

Think you’ve encountered an IRS scam? Need assistance with your tax preparation? Don’t hesitate to reach out to Lucia & Co. CPAs. Our team of experts is dedicated to ensuring your tax season is secure and stress-free. Contact us today for personalized support and guidance.